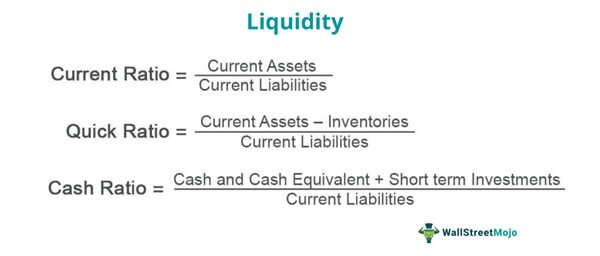

The key short term liquidity ratios are the current ratio and acid test ratio. The more liquid assets a company has, the better able it is to meet its short-term obligations as they become due. Current liabilities like accounts payable, short-term debt, and accrued expenses reflect near-term financial obligations. The Current Ratio, which divides current assets by current liabilities, measures a company’s liquidity and its ability to pay off debts within the next year. A higher current ratio indicates stronger liquidity and financial health. Tracking liquidity over time is important to assess the financial position and health of a business.

Liquidity ratios analysis

It is calculated by taking a company’s total current assets minus its total current liabilities. A higher ratio indicates that the company has enough liquid assets to cover all its short-term debt obligations without selling any other assets. This measures a company’s ability to pay off its short-term debts with liquid assets, such as cash equivalents or working capital.

Quick Ratio:

For example, suppose a company has Rs.2 million in current assets and Rs.1 million in current liabilities; its current Ratio would be as given below. Therefore, the company’s liquidity risk reduced substantially based on the improvement across each liquidity ratio. With that said, liquidity ratios can come in various forms, but the most common are as follows.

Basic Defense Ratio

The most common liquidity ratios are the current ratio, which compares its existing assets to its current liabilities. The net working capital ratio measures a company’s liquidity and its ability to meet short-term obligations. It looks at the difference between ultimate profit tracker for your business current assets and current liabilities. Current assets are cash, inventory, accounts receivable, and other assets that are converted to cash within a year. As opposed to the Current Ratio, the Net Working Capital Ratio puts more emphasis on current liabilities.

- We calculate all types of liquidity ratios by dividing a firm’s current assets by its liabilities.

- Both of them measure a company’s ability to use cash flow or asset’s to satisfy short-term liabilities that may arise in near future.

- Companies might face challenges in meeting their short-term obligations, leading to lower liquidity ratios.

- For example, suppose a company has Rs.2 million in cost of goods sold and an average inventory of Rs.500,000; its inventory turnover ratio is given below.

Comparing Liquidity Ratios

This information is useful to creditors when they decide how much money, if any, they would be willing to loan to a company and for what tenor. Liquidity ratios are used to evaluate how well-positioned a company is to meet its short-term obligations. In other words, liquidity ratios let investors know whether or not a firm has enough cash on hand to pay off its debts and bills as they become due.

Net Working Capital

It is calculated by dividing total existing assets by total current liabilities. The liquidity ratio is a measure of a company’s ability to pay off its short-term debts and obligations. It looks at the company’s current assets that are quickly converted to cash and compares that to the company’s current liabilities or debts due within the next year.

A higher debt-to-equity ratio indicates that more of the company’s assets are funded by creditors than shareholders, which can be risky. Another advantage of liquidity ratios is their utility in assessing a company’s financial health and risk level. A high liquidity ratio suggests that a company possesses sufficient liquid assets to handle its short-term obligations comfortably. The cash ratio is seldom used in financial reporting or by analysts in the fundamental analysis of a company. It’s not realistic for a company to maintain excessive levels of cash and near-cash assets to cover current liabilities.

This means there are 0.33 active military members per square kilometer of land. A higher ratio indicates a greater military presence and defense capability relative to the size of the nation. The ideal Ratio depends on a country’s defense strategy and perceived security threats. Most analysts consider a ratio above 0.5 to provide a strong territorial defense capability. For example, suppose a company has an average accounts receivable of Rs.1 million, annual credit sales of Rs.5 million, and the year has 360 days; its DSO would be as given below. However, the actual liquidity of these assets tends to be dependent on the company (and financial circumstances).

Businesses should strive for an absolute liquidity ratio of 0.5 or above. The cash or equivalent ratio measures a company’s most liquid assets, such as cash and cash equivalent to the entire current liability of the concerned company. Working capital and operating liquidity are extremely crucial for any business. As per the study, it was concluded that the average current ratio of ABB was 1.49 and Rockwell was 2.69 for the period – 2016. Less liquidity ratio of ABB suggested a liquidity crisis for the company in the short term. Likewise, the current ratio of Rockwell is more than 2 which indicates poor financial planning on part of the company.